Table of Content

Courtyard Gardens Nursing and Rehab Center located in Middletown, PA, in Dauphin County, offers a variety of therapies and care services to help you regain your independence. There are limits to courtyard garden design, but with a little creativity, you can work with them to create something great. For instance, if your courtyard is entirely bricked over, design a container garden.

Inspectors judge every nursing home facility on more than 180 different factors. Our residents truly feel like extended family — as do your pets! We’re an inclusive community that operates on the pillars of respect and empowerment, with programs to enrich and inspire your day with the support of 24/7 dedicated team to make each one a fulfilling one.

Complaints and Incidents

Nursing homes are rated from 1-star to 5-stars with 1-star being the best rating and 5-star being the best rating. For the Health Inspection Rating the nursing homes in each state are ranked based on their weighted three year inspection score. The top 10 percent of nursing homes are awarded a 5-star rating; the bottom 20 percent are awarded a 1-star rating. In between 1-star and 5-star, the remaining homes are divided equally into three tranches which correspond with the stars 2 to 4. The staff ratings and quality measure ratings follow a similar process but the divisions are based on a national ranking.

The division between star ratings is called the “cut-rate”. Cut-rates are redefined periodically and are published by CMS. CMS regularly inspects every skilled nursing facility. The health inspection scores are an absolute value, so you can compare one facility's score directly to another. The Overall Star rating is based on the facility's performance as compared to other facilities in the same state, so you cannot easily compare one facility's Overall star rating to a facility in another state. Medicare certified nursing homes must meet more than 180 rules created in order to protect nursing home residents.

Courtyard Gardens Violations, Complaints and Fines

It is also useful for patients recovering from surgery. If you are looking for a modest-sized facility, this nursing home fits the bill. Medicare and Medicaid are accepted, and counseling services are also available. The Courtyard Gardens is classified as a Skilled Nursing Facility. Many of our residents tell us that life at Courtyard Gardens is very nice. Some nursing homes have a combination of Medicare, Medicaid, and private beds.

Featured amenities include a 24-hour business center, express check-out, and dry cleaning/laundry services. This hotel has facilities measuring 2799 square feet , including conference space. Find a detailed description of Courtyard Gardens a Skilled Nursing Home in Wichita Falls, Texas on SeniorCare.care here.

Owner and Operator Information for Courtyard Gardens

Sign in to get personalized notifications about your deals, cash back, special offers, and more. By using our website, you agree to the terms of use and privacy policy. This report is updated weekly and shows new and historical infection levels.

Specializing in memory care and assisted living with supportive services. Camila is delighted to welcome you to Courtyard Gardens. Camila is full of life, optimistic, and a collaborative leader. Camila’s passion for seniors and service in excellence started when she was studying for her nursing degree. You can often find her walking in the community, visiting residents and her team; you may even see her sing and dance. When she is not working, you can find her travelling throughout the world, experiencing different cultures, walking her dog at the beach, and spending time with her family.

Your vibrant community will consist of other members who seek to enjoy an active and inspired next chapter of their lives, along with their friends. Every inch of Courtyard Gardens has been thoughtfully designed to provide a country club atmosphere and give an experience like no other. All the amenities you will ever need, in a space you will love. By February 28th, all of our residents will have received both doses of the Covid-19 Vaccine.

Courtyard Gardens is a nursing home in Wichita Falls, TX that has 46 residents living there. Courtyard Gardens has earned an Overall Star Rating of stars. Health is everything and that’s why we spend so much time making sure you live a healthy and active life. Our team of highly-skilled and empathetic health care professionals are available around the clock to ensure your immediate and future needs are met.

Welcome to Courtyard Gardens, a vibrant retirement living community where our goal is to encourage and support your independence. Enjoy the comfort and privacy of our own suite, with services and amenities designed to lighten your load and support you through life’s changes. Skilled nurses, therapists and licensed care professionals are available to guide you through your personalized therapy. Whether you’re recovering after a hospital visit or in need of on-going medical support, Courtyard Gardens Nursing and Rehab Center will help you achieve your personal goals. Selecting the right skilled nursing facility can be critical to your speedy recovery.

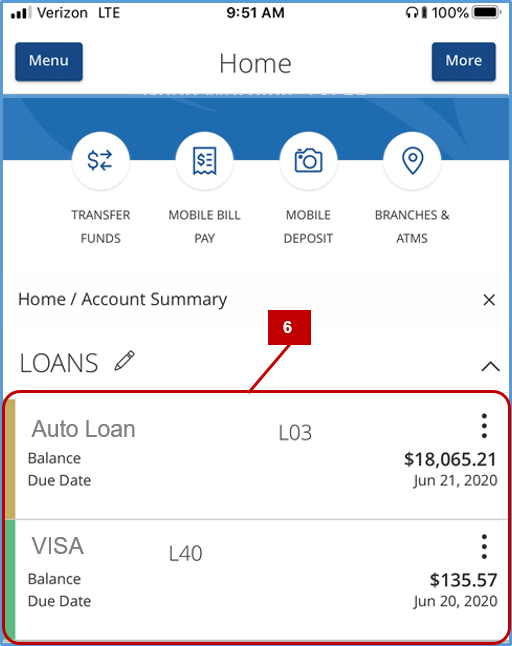

How does Courtyard Gardens compare to other skilled nursing facilities? This list shows the competitive set within a 25 mile radius. How long a nurse spends with a resident can be an important factor in their recovery. This page shows the average nursing hours spent per resident for RNs, LPNs, CNAs, PTs and all licensed staff.

Gardening in unique spaces takes extra creativity and inspiration. Knowing how to create a courtyard garden may not be intuitive, but with a little imagination and examples of existing gardens, you can easily design a beautiful, functional outdoor space for this purpose. The process for health inspections at nursing home facilities takes into consideration all of the important elements of a person’s care in a nursing home.